How to avoid paying VAT? Cart2Cart FAQ

What is the EU VAT number? Who should have an intra-Community VAT number? How do I apply for my VAT number? How do I check a company's VAT number? What happens if the VAT number is.

VAT ID 2020 All about the VAT identification number [Instruction]

You can find your own VAT identification number in the Tax Administration's online portal for entrepreneurs. Checking validity of clients' VAT ID numbers

Can I Add My VAT ID on The Invoices?

VAT id cos'è? Per controllare e verificare il numero di partita iva delle imprese registrate all'interno dell' UE, è stato predisposto uno strumento elettronico: il VAT identification number nel sistema VIES. Vediamo insieme di che si tratta e, soprattutto, come funziona. Ebbene, iniziamo col dire che il codice Vat id rientra nel.

VAT ID LookUp Check VAT IDs intuitively and professionally even as

A VAT number or Tax Identification Number (TIN) is a unique identifier for companies, individuals and entities within the European Union's Value Added Taxation scheme. This utility provides access to VIES VAT number validation service provided by the European commission. It also supports VAT checking for countries which are not part of the EU.

Fatma VAT Medium

Nello specifico, col VAT Number parliamo di strumento elettronico utile a verificare il numero della partita IVA, di tutte le imprese registrate all'interno della comunità europea. Lo scopo del codice e' di controllare che il numero di Partita IVA di imprese e professionisti di tutta la UE sia effettivamente valido.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

Help to identify the place of taxation Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT.

Do you need help with your VAT? Scott Vevers can take the stress out of

Learn about the Legal Entity Identifier (LEI) and the RSIN number you get when you register your company at the Netherlands Chamber of Commerce.

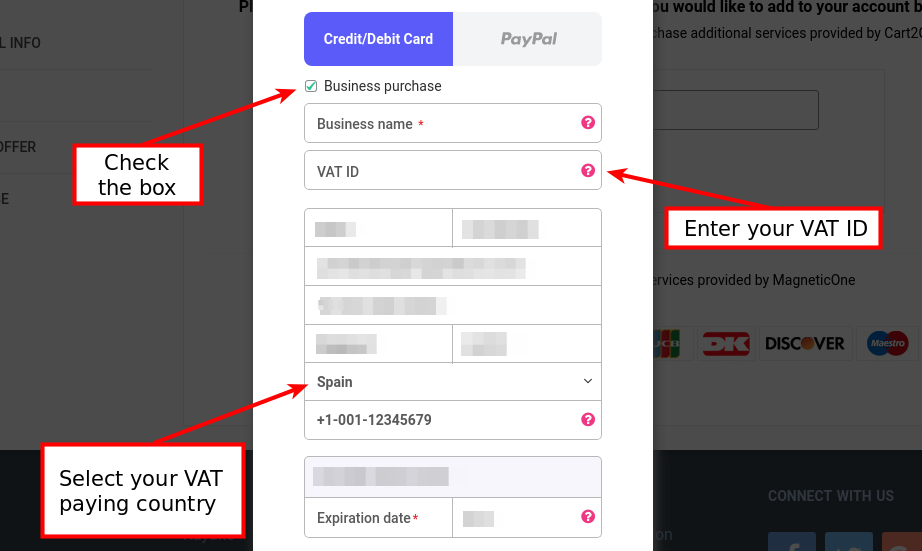

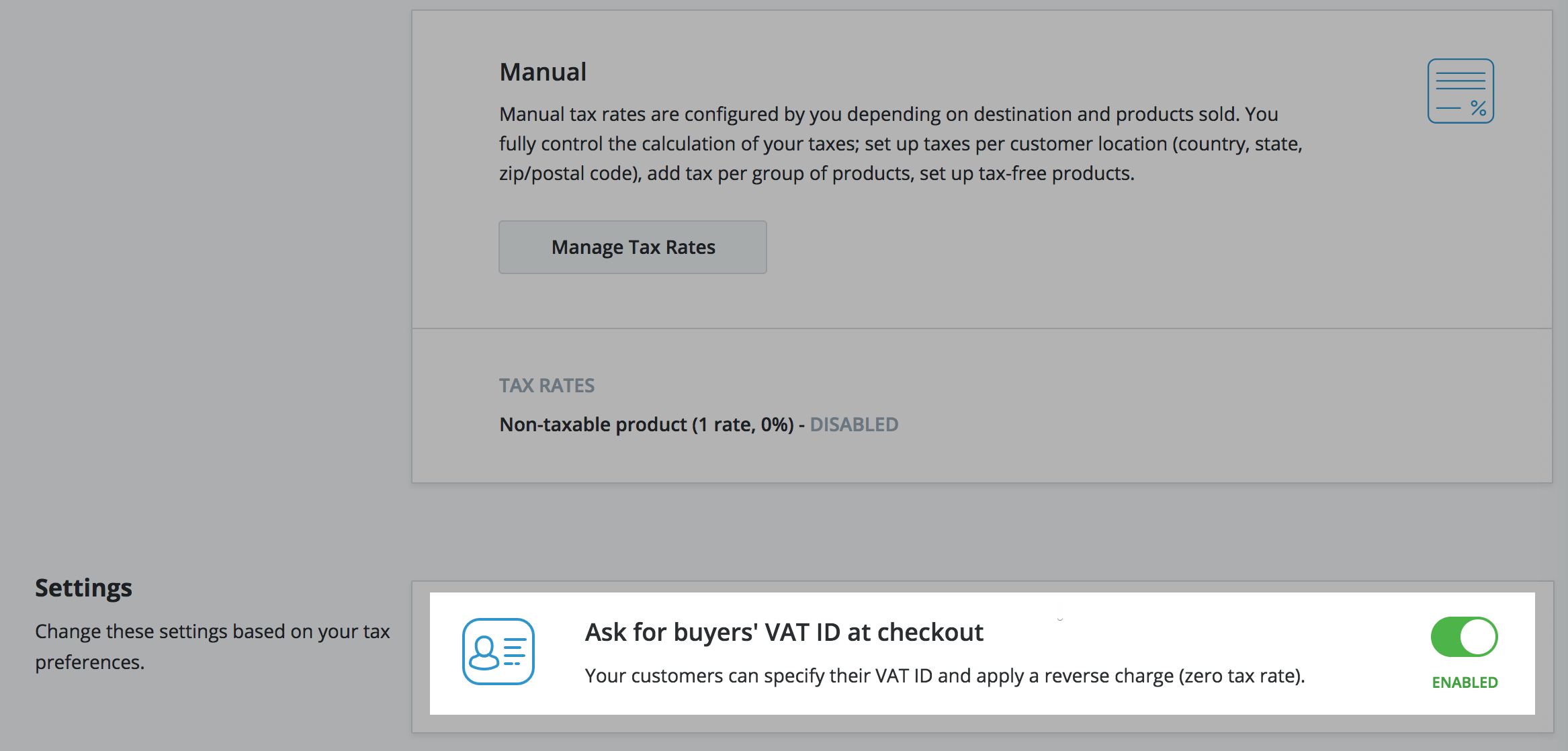

EU taxes (VAT) in Ecwid Ecwid Help Center

VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.

VAT ERP Software Partner Wanted Bahrain and XXX VAT Compliant

Geniosoft A chi effettua transazioni e acquisti intracomunitari potrebbe essere richiesto il VAT number. Scopri cos'è e come verificarlo con questa guida.

Handling VAT Identification No. and Group VAT ID AppVision Kft.

VAT ID is an alphanumeric identifier of companies in the European Union, which are registered VAT payers. You can read more about VAT ID format later in this article. VIES hosts an up to date database of European Union businesses registered as VAT payers.

VAT EFiling System Introduction for Tanzanian Businesses SmartErp

Antonia Klatt Last Updated on 6 September 2023 What is a VAT ID? The VAT Identification number identifies all companies in the European Union and is indispensable for intra-European trade. It can be obtained by registering vor VAT. When trading within the EU (intra-community supply/service) a VAT ID for making sure that taxes are paid is mandatory.

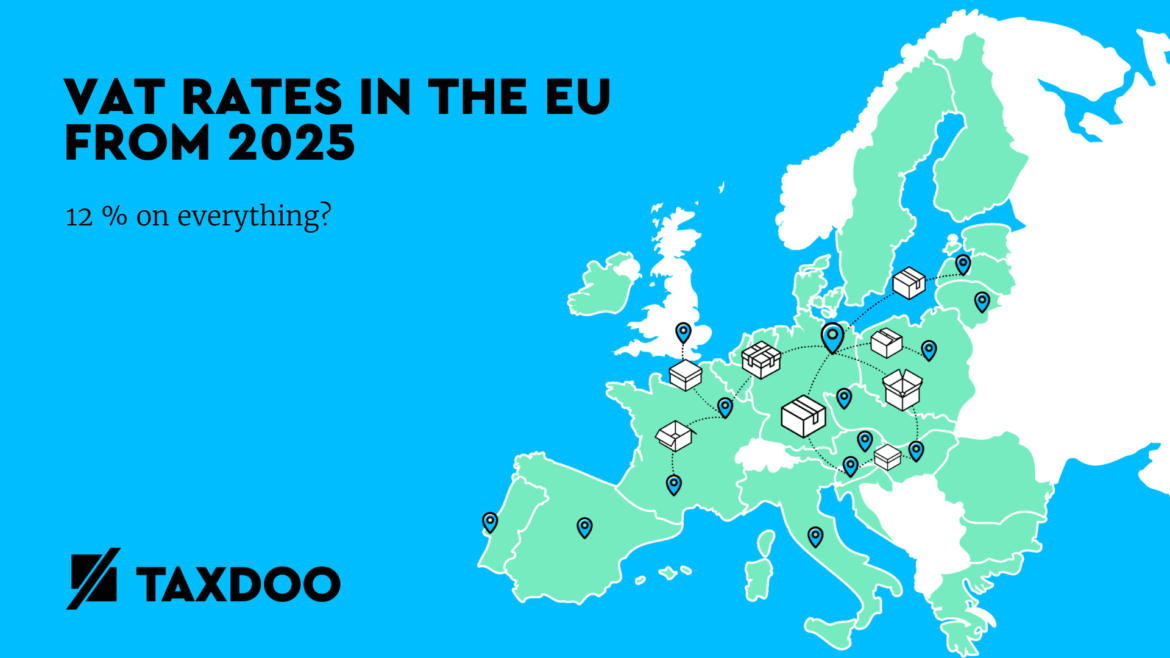

VAT ID and country of origin for Intrastat declarations as of 2022 Taxdoo

Che cos'è il VAT identification number? Il VAT identification number, fa parte del sistema VIES per lo scambio di informazioni relative all'IVA e serve per il controllo e verifica validità del numero di Partita IVA di imprese e professionisti di tutta l'Unione europea.

Što je VAT ID, kada ga koristiti i čemu služi?

Such information includes the VAT identification number, the trader's name, the trader's address. Distributions (2) Link to the data. Format. Updated. Actions. HTML. Technical Information Show more. 20.09.2023 Preview. Access keyboard_arrow_down. Linked data keyboard_arrow_down. HTML. VIES VAT number validation

What Is A VAT ID? Lee Daily

A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

VAT Returns First Base Knowledge

The Commission´s web site is a real-time system which checks the validity of VAT identification numbers against the databases maintained by Member States / Northern Ireland. In other words, when you check a number, it is the database of that Member State / Northern Ireland that is being checked.If the VAT number of your customer comes up as.

VAT in UAE Value Added Tax in Dubai VAT SAB Auditing

General information about TINs by country (when the Member State's tax administration has chosen to publish this information): descriptions of the structure and specificities of the national TIN, examples of official documents showing the TINs, national websites and contact points. 24 NOVEMBER 2023 Tin by Country EN English (10.64 MB - ZIP)